Effective payment processing is essential for any business. Swipe One Payment Processing simplifies this task.

Swipe One is an AI-powered CRM and marketing platform. It helps agencies manage clients and automate tasks. You can handle client relationships, sales, and marketing from one place. This tool not only saves time but also boosts efficiency. With features like workflow automation and personalized email campaigns, your business can thrive. By integrating with popular tools like Gmail and Shopify, it fits seamlessly into your workflow. Swipe One offers a unified platform for all your needs. It’s designed for ecommerce, SaaS, and small businesses. Discover how Swipe One can transform your client management and marketing efforts. For more details, check out the product on Swipe One.

Introduction To Swipe One Payment Processing

Welcome to the world of Swipe One Payment Processing. This AI-powered CRM and marketing platform helps agencies manage client relationships, automate marketing tasks, and send email campaigns. Everything is done from one convenient platform.

What Is Swipe One?

Swipe One is an advanced CRM and marketing automation tool. It integrates AI to help manage client relationships, automate marketing and sales tasks, and streamline email campaigns. It's designed to handle everything from contact organization to workflow automation.

Purpose And Benefits Of Swipe One

The main purpose of Swipe One is to simplify and automate various tasks. This includes managing client relationships and marketing campaigns. Its benefits include:

- Unified Platform: Manage all tasks from one place.

- Automation: Save time with AI-powered automation for lead nurturing and email campaigns.

- Scalability: Efficiently scale operations with AI agents and tailored workflows.

- Personalization: Enhance client communications with personalized email campaigns.

Key Features

| Feature | Description |

|---|---|

|

View, filter, and organize contacts. Track emails, purchases, subscriptions, and sales team notes. Create custom properties and advanced filters. |

|

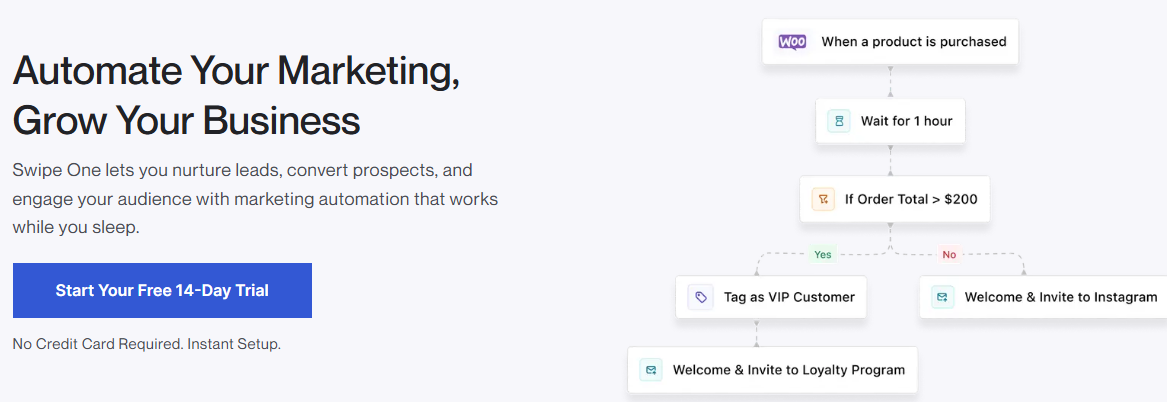

Set up workflows to nurture leads, send follow-ups, and trigger actions based on customer behavior. Optimize automations with analytics and A/B testing. |

|

Automate marketing tasks like lead research, email writing, and social media posts. Generate personalized emails, tweets, and LinkedIn posts quickly. |

|

Personalize emails using dynamic tags, pre-built templates, and AI-generated content. Schedule or send email campaigns instantly. |

Pricing Details

Swipe One offers flexible pricing tiers:

| License Tier | Price | Details |

|---|---|---|

| License Tier 1 | $69 | 2,500 contacts, 25,000 email sends/month, 250 AI credits/month, 1 team member, 1 workspace, 1 domain |

| License Tier 2 | $179 | 7,500 contacts, 75,000 email sends/month, 1,000 AI credits/month, 5 team members, 2 workspaces, 2 domains |

| License Tier 3 | $349 | 15,000 contacts, 150,000 email sends/month, 2,000 AI credits/month, 10 team members, 4 workspaces, 4 domains |

| License Tier 4 | $599 | 30,000 contacts, 300,000 email sends/month, 5,000 AI credits/month, 20 team members, 8 workspaces, 8 domains |

Swipe One is also refundable for up to 60 days, giving you ample time to ensure it’s the right fit for your needs.

Key Features Of Swipe One Payment Processing

Swipe One Payment Processing is designed to streamline your agency's financial transactions. It offers several key features that make it a preferred choice for businesses. Let's dive into the core functionalities.

User-friendly Interface

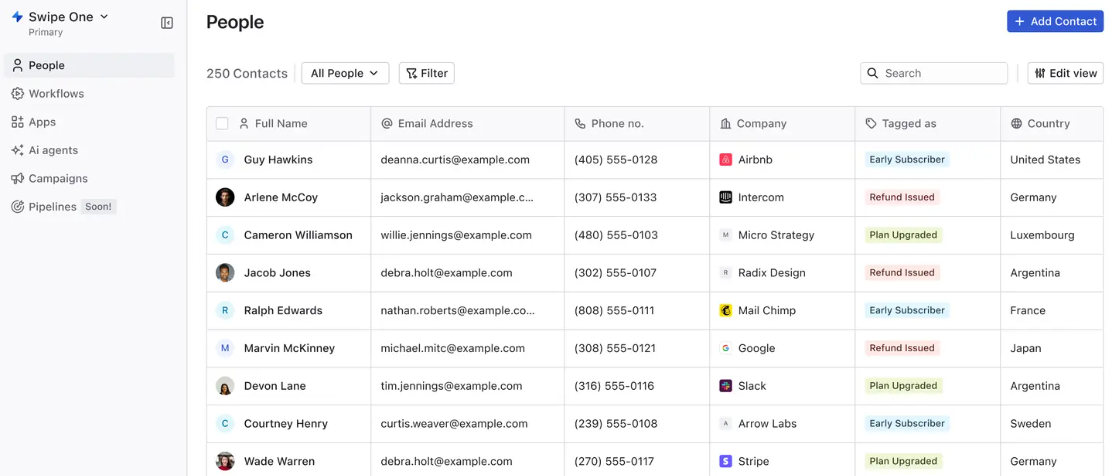

Swipe One boasts a user-friendly interface that simplifies the payment process. The dashboard is intuitive and easy to navigate. You can view, filter, and organize contacts on a spreadsheet-like interface. Tracking emails, purchases, subscriptions, and sales team notes is all possible from one place. Custom properties and advanced filters help in better contact engagement.

Secure Transactions

Security is paramount with Swipe One. The platform ensures secure transactions using advanced encryption techniques. It complies with industry standards to protect sensitive data. Clients can rest assured their payment information is handled safely. The platform supports secure payment gateways and fraud detection mechanisms.

Multi-currency Support

Swipe One supports multi-currency transactions. This feature is essential for businesses operating globally. The platform can process payments in various currencies, making international transactions seamless. Customers can pay in their preferred currency, enhancing their experience. This flexibility can help expand your business reach.

Real-time Analytics

With Swipe One, you get real-time analytics. The platform provides detailed insights into your transactions. You can monitor payment trends, track sales, and analyze customer behavior. This data helps in making informed decisions and optimizing your sales strategy. Real-time analytics ensure you stay updated with your financial performance. In conclusion, Swipe One Payment Processing offers a user-friendly interface, secure transactions, multi-currency support, and real-time analytics. These features make it a comprehensive solution for managing client payments efficiently.

How Swipe One Simplifies Transactions

Swipe One is an AI-powered CRM and marketing automation platform designed to help agencies manage client relationships, automate marketing and sales tasks, and send email campaigns—all from one platform. This powerful tool simplifies transactions in several key ways, making it easier for businesses to manage their processes efficiently.

Streamlined Payment Processes

With Swipe One, businesses can enjoy streamlined payment processes that save time and effort. The platform allows users to view, filter, and organize contacts on a spreadsheet-like interface. This makes tracking emails, purchases, and subscriptions easier. Additionally, users can create custom properties and advanced filters to engage with their contacts more effectively.

| Feature | Description |

|---|---|

| View Contacts | Organize contacts on a spreadsheet-like interface |

| Track Transactions | Monitor emails, purchases, and subscriptions |

| Custom Properties | Create personalized filters to engage contacts |

Automated Reconciliation

Swipe One offers automated reconciliation, which helps businesses manage their finances with ease. The platform sets up workflows to nurture leads, send follow-ups, and trigger actions based on customer behavior. This ensures that all transactions are accurately recorded and reconciled, reducing the risk of errors and saving time.

- Nurture leads with automated workflows.

- Send follow-ups automatically

- Trigger actions based on customer behavior

Integration With Existing Systems

Swipe One integrates seamlessly with existing systems such as Gmail, Pabbly Connect, Shopify, Stripe, and Zapier. This allows businesses to continue using their preferred tools while benefiting from the enhanced capabilities of Swipe One. Integration ensures a smooth transition and compatibility with current workflows.

- Gmail

- Pabbly Connect

- Shopify

- Stripe

- Zapier

By integrating with these systems, Swipe One simplifies transactions and enhances efficiency, making it an invaluable tool for businesses of all sizes.

Pricing And Affordability Of Swipe One

Swipe One offers a range of pricing options designed to suit various business needs. Whether you are a small business or an agency, Swipe One provides affordable solutions that combine powerful CRM and marketing automation features.

Subscription Plans

Swipe One has four distinct subscription plans, each tailored to different levels of business requirements:

| License Tier | Price | Contacts | Marketing Email Sends/Month | AI Credits/Month | Team Members | Workspaces | Domains |

|---|---|---|---|---|---|---|---|

| License Tier 1 | $69 | 2,500 | 25,000 | 250 | 1 | 1 | 1 |

| License Tier 2 | $179 | 7,500 | 75,000 | 1,000 | 5 | 2 | 2 |

| License Tier 3 | $349 | 15,000 | 150,000 | 2,000 | 10 | 4 | 4 |

| License Tier 4 | $599 | 30,000 | 300,000 | 5,000 | 20 | 8 | 8 |

Transaction Fees

Swipe One does not charge additional transaction fees. This ensures that businesses can focus on their growth without worrying about unexpected costs. The pricing structure is transparent, making it easier to manage expenses.

Cost-effectiveness

Swipe One's pricing is designed to be cost-effective for various business sizes:

- Small Businesses: The License Tier 1 plan at $69 offers a budget-friendly option, providing necessary features without breaking the bank.

- Growing Agencies: License Tiers 2 and 3 offer scalable options that grow with your business. These tiers include more contacts, emails, and AI credits.

- Large Enterprises: The License Tier 4 plan at $599 is ideal for large teams, offering extensive features and higher limits on contacts and emails.

Swipe One's lifetime access deal ensures long-term savings, eliminating recurring monthly fees. The cost-effectiveness is further enhanced by the inclusion of AI-powered automations, helping businesses save time and resources.

Pros And Cons Of Swipe One Payment Processing

Deciding on a payment processing solution is crucial for any business. Swipe One offers a range of features and benefits, but it also has some limitations. Let’s explore the pros and cons of using Swipe One for your payment processing needs.

Advantages Of Using Swipe One

Swipe One provides several advantages that can streamline your business operations:

- Unified Platform: Manage client relationships, marketing, and sales tasks from a single interface. This reduces the need for multiple software solutions.

- Automation: Save time with AI-powered automations for lead nurturing, email campaigns, and content creation. This helps in efficiently managing customer interactions.

- Scalability: Efficiently scale your operations with AI agents and tailored workflows. This makes it suitable for growing businesses.

- Personalization: Enhance client communications with personalized email campaigns. Use dynamic tags and AI-generated content to improve engagement.

- Cost-Effective Pricing: Competitive pricing with different license tiers to suit varying business needs. Options range from $69 to $599 with varying levels of contact and email limits.

- Integrations: Seamlessly integrates with Gmail, Pabbly Connect, Shopify, Stripe, and Zapier. This ensures smooth workflow across different platforms.

Potential Drawbacks And Limitations

While Swipe One has many benefits, it also has some potential drawbacks:

- Initial Learning Curve: New users might find the platform complex initially. It may take some time to get familiar with all the features.

- Limited AI Credits: The number of AI credits is limited per license tier. Businesses with high automation needs might require higher tiers.

- Team Member Restrictions: Lower license tiers have restrictions on the number of team members. This might be limiting for larger teams.

Advanced Features Cost More: Access to more advanced features and higher limits comes with higher license tiers. This could be a consideration for budget-conscious businesses.

| License Tier | Contacts | Emails/Month | AI Credits/Month | Team Members | Workspaces | Domains | Price |

|---|---|---|---|---|---|---|---|

| Tier 1 | 2,500 | 25,000 | 250 | 1 | 1 | 1 | $69 |

| Tier 2 | 7,500 | 75,000 | 1,000 | 5 | 2 | 2 | $179 |

| Tier 3 | 15,000 | 150,000 | 2,000 | 10 | 4 | 4 | $349 |

| Tier 4 | 30,000 | 300,000 | 5,000 | 20 | 8 | 8 | $599 |

Ideal Users And Scenarios For Swipe One

Small business owners and freelancers benefit from Swipe One Payment Processing. It's ideal for retail shops, cafes, and online stores.

Swipe One is an AI-powered CRM and marketing automation platform. It helps agencies manage client relationships and automate marketing tasks. Its diverse features make it suitable for various users and scenarios. Here are some ideal users and scenarios for Swipe One:

Small Businesses

Small businesses benefit greatly from Swipe One. It offers a unified platform to manage client relationships, marketing, and sales tasks. This is especially useful for small teams with limited resources. The ability to automate workflows and email campaigns saves time and boosts productivity. With License Tier 1, small businesses can manage up to 2,500 contacts and send 25,000 marketing emails per month. This tier also includes 250 AI credits and supports one team member. It's an affordable solution that meets the needs of small businesses. Small businesses can use Swipe One to:

- Organize contacts and track interactions.

- Automate lead nurturing and follow-ups.

- Create and schedule personalized email campaigns.s

E-commerce Platforms

For e-commerce platforms, Swipe One is a valuable tool. It integrates with Shopify, Stripe, and Zapier, making it easy to manage online sales and customer interactions. The advanced filters and custom properties help e-commerce businesses engage with their customers more effectively. E-commerce platforms can also benefit from the email marketing features. They can personalize emails using dynamic tags and pre-built templates. This enhances customer engagement and drives sales. E-commerce platforms can use Swipe One to:

- Track purchases and subscriptions

- Automate marketing tasks like lead research and email writing

- Generate personalized social media pos.ts

Service-based Industries

Service-based industries, such as agencies and consultancies, find Swipe One extremely useful. The platform's workflow automation helps streamline processes and improve efficiency. The AI agents assist in automating marketing tasks, allowing service providers to focus on their clients. With License Tier 3, service-based industries can manage up to 15,000 contacts and send 150,000 marketing emails per month. This tier includes 2,000 AI credits and supports up to 10 team members. It is ideal for growing agencies and consultancies. Service-based industries can use Swipe One to:

- Manage client relationships efficiently.

- Automate follow-ups and trigger actions based on customer behavior

- Optimize marketing strategies with A/B testing and flow analytics

Is Swipe One Right For You?

Swipe One offers a comprehensive solution for managing client relationships and automating marketing tasks. But is it the right fit for you? Let's review the key points and provide final recommendations to help you decide.

Summary Of Key Points

- Client Relationship Management (CRM): Organize and track contacts with an intuitive interface. Custom properties and advanced filters enhance engagement.

- Workflow Automation: Nurture leads and trigger actions based on customer behavior. Optimize with analytics and A/B testing.

- AI Agents: Automate tasks like lead research, email writing, and social media posts. Generate personalized content quickly.

- Email Marketing: Personalize emails with dynamic tags and AI-generated content. Schedule or send campaigns instantly.

- Unified Platform: Manage client relationships, marketing, and sales from a single platform.

- Scalability: Efficiently scale operations with AI agents and tailored workflows.

- Personalization: Enhance communications with personalized email campaigns.

Final Recommendations

If you are an e-commerce, SaaS, or small business, Swipe One can streamline your client management and marketing efforts. Here are some considerations based on pricing tiers:

| License Tier | Price | Features |

|---|---|---|

| Tier 1 | $69 | 2,500 contacts, 25,000 emails/month, 250 AI credits/month, 1 team member |

| Tier 2 | $179 | 7,500 contacts, 75,000 emails/month, 1,000 AI credits/month, 5 team members |

| Tier 3 | $349 | 15,000 contacts, 150,000 emails/month, 2,000 AI credits/month, 10 team members |

| Tier 4 | $599 | 30,000 contacts, 300,000 emails/month, 5,000 AI credits/month, 20 team members |

Take advantage of the 60-day refund policy to test Swipe One. Ensure it meets your needs before committing. Swipe One integrates with tools like Gmail, Shopify, and Zapier, making it a flexible choice for various business needs.

FAQs About Swipe One payment processing

What Is Swipe One Payment Processing?

Swipe One Payment Processing is a service that enables businesses to accept various forms of payments. It supports credit cards, debit cards, and mobile payments.

How Does Swipe One Payment Processing Work?

Swipe One uses secure technology to process transactions. Customers swipe their cards, and the system handles the payment verification and transfer.

What Are The Benefits Of Swipe One?

Swipe One offers fast, secure, and reliable payment processing. It helps increase sales by accepting multiple payment types.

Is Swipe One Payment Processing Secure?

Yes, Swipe One uses advanced security measures. It ensures all transactions are safe and compliant with industry standards.

Conclusion

Swipe One simplifies client management for agencies. Its AI tools save time. The platform's automation features enhance efficiency and personalization. With various pricing tiers, Swipe One suits different needs and budgets. Start managing your clients better today with Swipe One. Learn more here.